Want to make it easier for business? Make energy cheaper! (REODB 5)featured

Running a business is easier if costs are low. This is something I learnt as a cofounder in my company. The lesson was reinforced two years ago, when I met nearly fifty business leaders across the country and talked to them for hours about their businesses. It seems obvious that lower costs would make it easier to operate a business. Yet, the now discontinued Ease of Doing Business ratings of the World Bank, did not consider costs! Since our series is on Real Ease of Doing Business (REODB), we would be writing on some of the major costs for businesses in our next few posts. If India can reduce these costs, more businesses will flourish. Our first post will be on cost of energy. The cost of energy for businesses is much higher that it could be. Before we look at the underlying reasons, let us consider if cost of energy matters.

Does cost of energy matter?

The cost of energy is crucial for some businesses and not so critical for others. On one end of spectrum is Aluminum smelting. The cost of electricity is the most crucial cost in this process. That is why Aluminum smelting plants are located next to cheap sources of electricity. On the other end of the spectrum are high value businesses such as software. Electricity costs are a very small proportion of their total costs. Many businesses fall in between, where energy costs are of significant concern but are not the biggest one. Let us look at some examples.

I was surprised to find out that electricity cost was the second biggest cost for a coworking space that I worked in. The same was true for a theater that hosted live shows. Air conditioning costs a lot. Energy costs are critical for many small and informal businesses too. Alok picks up clothes from my home, irons them and brings them back. In my conversations with him, he has mentioned electricity bill as his biggest expense. For all these businesses, if the energy costs were lower, they would have a higher chance of thriving and employing more people.

Electricity is not the only form of energy used by businesses. Manufacturing steel in blast furnaces and manufacturing cement may use coal directly. The most widespread use of non-electric energy is in transport. Businesses transport their goods to customers using fossil fuel powered vehicles. Also, their employees use fossil fuel-based vehicles to reach their place of work and these costs can be very important for the businesses. In this post, we will begin by looking at the cost of fossil fuels, but first, a few words on methodology.

In this piece, I have not used price comparisons across countries. Rather, I have shown that businesses have to pay a lot more for energy because of government interventions and inefficiencies. I believe that cross country comparison is of limited value when thinking about Real Ease of Doing Business. This is true because of two reasons. First, most business are focused domestically and international comparisons do not make sense for them. For example, a theater owner in Mumbai does not care if she pays less for electricity than her counterpart in Berlin. All she knows is that a high bill for energy leaves less money for her employees and for her bottom line. Secondly, as a country we want more and more businesses to flourish so that many more people get meaningful employment. We should be using all the advantages we have and not get bogged down thinking about whether some other society across the globe has more or less of such advantages. That kind of thinking is best left to academics unless you are looking at a select few globally competitive businesses.

Coal is the biggest source of energy in India and we begin with that.

Why is coal more expensive than it could be?

India meets most of its energy requirements from coal. According to Coal India, 55% of energy requirements of the country and 69% of electricity requirements are met by coal. [1] In 2020–21, Coal India Limited contributed nearly 42, 000 Crores by way of duties, Royalty, GST and other taxes and levies. Additionally, the company paid Rs. 5,300 Crores of Income Tax and made dividend payments of Rs. 7,700 Crores. Note that the price of coal is fixed by the government at a high level so that Coal India Limited is in a financial position to pay the Income Tax and the Dividend. Total amount of money that the central and state governments got from the company was more than Rs. 50,000 Crore.

Note that CIL accounted for 83% of country’s coal output and governments would extract money from other producers too. Also, note that 2020–21 was a slow year for the company and in previous years, the amount of money that the governments got was at least 20% more. Also, note that India imports a significant quantity of coal and the importers of this coal have to pay import duty on it. In 2020–21, India imported 215 MT of coal worth Rs. 1,16,037 Crores.

Businesses that use coal directly — such as steel and cement producers — have to pay a higher cost for their ingredients than it would have been the case if all these taxes and levies were not imposed. Coal is used to produce electricity and high price of coal directly means high cost of electricity.

The contribution of coal sector to government finances is huge. However, it does not look big when compared with the contribution that petroleum products make. Let us look at that next.

Why are petroleum products more expensive?

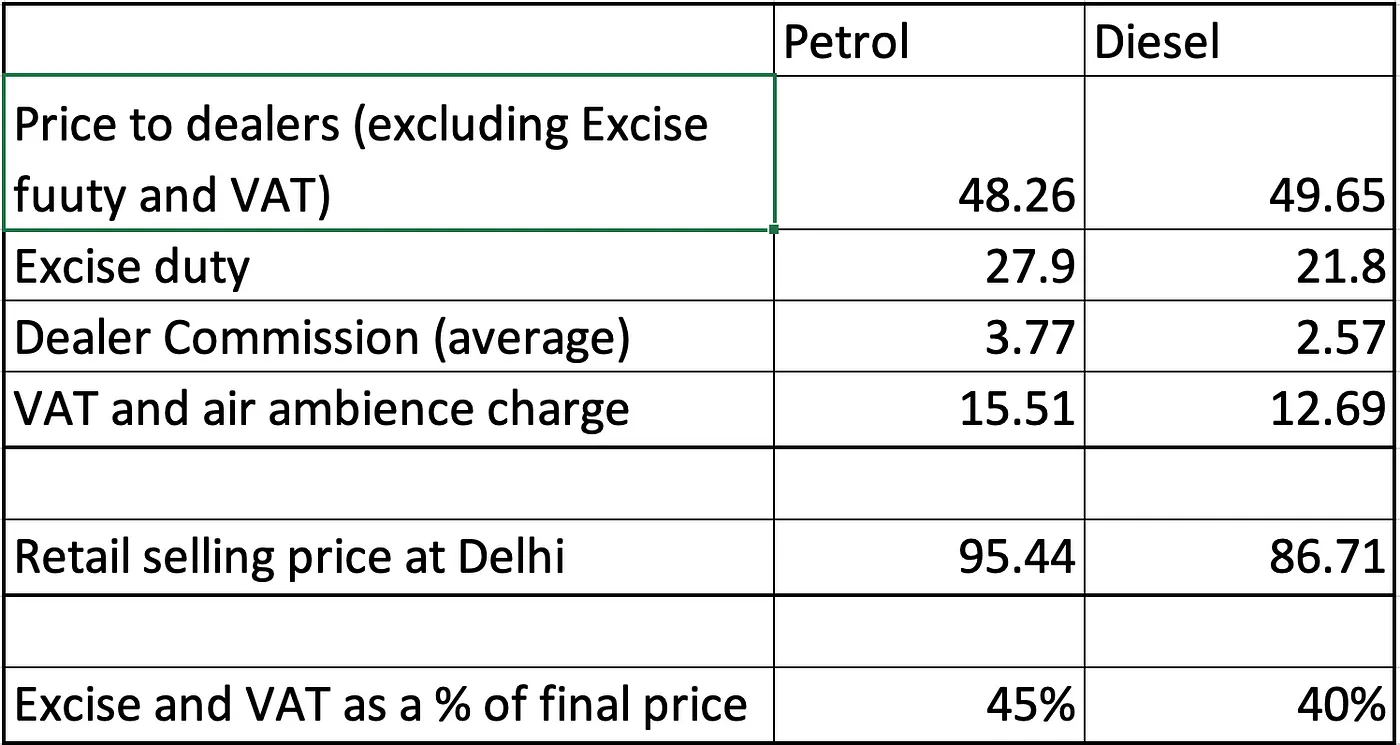

Hindustan Petroleum publishes the breakdown of pump prices in Delhi. I have given this breakdown as of March 16th

Government taxes form a very high proportion of the final price to the consumers. Note that the proportion given above does not include any taxes that would have been charged on import of crude and on production of domestic crude. Also note that the price at petrol pump is higher in most other states as the state government taxes in those states are even higher. The oil sector also contributes to the central government by way of dividends and income taxes and prices are fixed to ensure a large flow to the government.

High taxes and duties on Petroleum products are charged because governments in India depend a lot on these to balance their budget. According to Ministry of Petroleum and Natural Gas, the contribution of petroleum sector to the central exchequer was Rs. 4,55,069 Cores in 2020–21. According to the Revised estimates for 2020–21, total receipts of the government of India (without borrowings) were Rs. 16,01,650 Crore. The contribution of petroleum sector to this was nearly 30%! The contribution of the sector to the state exchequer was Rs. 2,17,650 Crores.

Of course, not all of these taxes were charged to businesses, but there is no doubt that businesses would pay much lower amounts for buying petroleum products if it were not for the high dependence of government finances on petroleum sector.

Edit 1: Note, that businesses cannot get tax credit for indirect taxes paid on petroleum products unlike the credit they may get on GST paid on other inputs.

As an aside, there is a lot of talk of imposition of Carbon tax to help tackle climate change. While India does not call this humongous contribution of fossil fuel to the exchequer as Carbon Tax, the taxes and the high prices act as a deterrent to the use of fossil fuel and act as Carbon taxes. In that sense the country must have one of the highest carbon taxes in the world!

The energy source that virtually every business uses is electricity. The cost of electricity is much higher for businesses than it could be. Let us look at that next.

Why is Electricity more expensive than it could be?

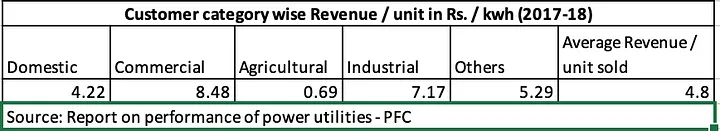

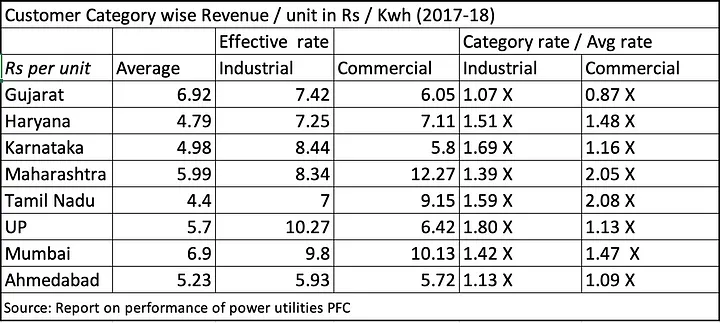

Commercial and industrial customers are charged at a much higher rate than domestic and agricultural customers.

We have seen that the price of the main source of electricity — coal — is much higher than it could be because of the contribution that coal makes to government finances. There are other reasons for the high cost of electricity. These are

· A lot of electricity made from expensive coal is lost (Technical losses) and also because many customers do not pay their billed amount (Commercial losses)

· India has made many uneconomic decisions in the past and hence, we transport coal over long distances rather than transmitting electricity.

· The cost is likely to go up in future with induction of renewable energy.

The burden of this high cost falls disproportionately on commercial and industrial customers as they cross subsidize agricultural and domestic customers.

Let us look at each of these factors in turn.

Aggregate Technical and Commercial losses

The efficiency of distribution companies in India is measured using the Aggregate Technical and Commercial Losses (AT&C). This measure combines technical losses and commercial losses. The AT&C losses for 2019–20 were 20.93%. Revenue foregone because of each percent of AT&C loss is approximately five to six thousand Crores!

The high AT&C losses is the big reason for the cost of electricity being much higher than it could be. There are other reasons too. One of the more insidious ones is the location of our power plants.

Uneconomic decisions made

As discussed, more than two thirds of electricity generated in India is from coal fired power plants. The coal for most of these plants comes from coal fields in the Eastern part of the country. It is costlier to transport coal than to transport electricity. However, for various historical reasons, we have coal power plants based in as far-flung states as Haryana and Punjab and the cost of electricity generation from these plants is higher than if the same plants were located near the coal mines.

That is not all. Domestic coal shortages have meant that we have imported coal and transported it to distant Uttar Pradesh! There is a government of India policy to reverse this import of coal. I am not sure however, how successful it has been.

Even as we pay for the uneconomic decisions of the past, we are currently implementing policies that will further increase the cost of electricity in years to come. Renewable energy — being aggressively inducted in the Indian grid — will increase the cost of electricity. Let us look at that next.

Renewables — driving the cost of electricity higher

Renewable energy already makes electricity more expensive than it could be and as we increase the proportion of electricity from wind and solar energy, the price of electricity in our grid will increase further. Let me explain.

Distribution companies contracted with solar and wind energy producers in the past years at high tariff. As per those contracts, the distribution companies are bound to buy electricity from these companies whenever they are producing it, even if they have cheaper alternates available. In fact, regulators specifically force them not to curtail supply from renewable sources.

Many of these contracts are from the time when renewable electricity (solar energy specially) was much more expensive than it is today. With the falling cost of renewable energy, is this problem solved? No. To understand this, we need to understand the true cost of renewables.

Consider a grid which has a maximum demand of 1,000 MW. Suppose that the grid has 6 coal plants of 200 MW each to meet the demand. Why 6 and not 5? Because, power plants need to undergo maintenance and if the grid operator wishes to meet all customer demand, then the total supply needs to be more than the demand. Now what happens when say 200 MW of new solar energy comes online? Can we ‘retire’ one of the old coal power plants?

Not if the peak demand in the grid comes at a time when the solar power plant cannot produce electricity. In Indian grids, the peak demand for electricity comes in the evening hours when the sun does not shine and there is no possibility of solar generation. What this means is that the grid will need to pay the coal power plants for their capital charges even as they tell them not to generate in the day because they will be needed at night.

Note that it gets worse as the demand in the grid rises. Presumably, the peak would still be in the evening and supply is being added in the afternoon. To meet the demand then the grid will need to add thermal generation too. So, the grid will pay for capital charges of thermal plants and pay for electricity charges of solar plants. We have explained this concept in detail here but this metaphor explains the problem well. If your wicketkeeper in a cricket team is not good, you need to keep a backup fielder and that imposes costs for the team.

Note that a grid may need to cater to not just daily variation in supply but also to variation across seasons. In monsoon months the solar plants will not generate electricity and the grid would need thermal plants for backup. They would have to pay the full capital charges of these plants even if they are backup. Note that the cost of storage of electricity is very high and hence is currently not a practical option. Additionally, renewable energy also imposes technical costs on the grid which increase the cost of electricity further.

The cost of electricity is higher than it could be due to high price of coal and due to AT&C losses and uneconomic decisions. The burden of this high cost falls disproportionately on industrial and commercial customers. Let us look at that next.

Cross subsidy

As we saw, the electricity rates for industrial and commercial customers are way more than those for domestic and agricultural customers. This is true across the country. In a few states electricity is free for farmers and for very poor households. In many others, it is unmetered and provided at a flat rate. The utilities providing this free electricity are compensated by state government subsidy and by charging a higher tariff to industrial and commercial customers (Cross subsidy). Anytime the cost of electricity increases in the country, the burden is taken disproportionately by businesses. That is, a cost increase will fall much more on businesses and on state government subsidies than it does on agricultural and poor domestic consumers. This is true across states as this table shows

Note that I am not arguing here whether poor people and farmers in India should or should not get electricity at subsidized rates. All l am saying is that when businesses — that is industrial and commercial customers — have to bear the burden of high cost of power, their Cost of Doing Business is higher than it would otherwise have been.

Edit 2: Note that businesses cannot get input tax credit for electricity duty unlike the credit they get for other inputs.

Edit 3: Many businesses need to keep a back up electricity supply system because of unreliability of grid supply. This imposes even more costs on those businesses.

Summary and discussion

Energy in India comes mainly from coal and petroleum products. Businesses use coal directly or they use electricity and most of electricity is generated using coal. Businesses also use petroleum products. The energy cost for business is much higher than it could be because

· High taxes and duties on petroleum and their high prices that allow governments to get Income Taxes and Dividends from companies selling petroleum products.

· High taxes and duties on coal and its high price that allows government to get Income Taxes and Dividends from companies selling coal.

Additionally, electricity is expensive for businesses because

· Electricity distribution companies have high Technical and Commercial losses. This takes the cost of electricity up and the burden of this cost falls disproportionately on business customers.

· India has made many economically bad decisions when it comes to electricity. For example, we have power plants in North of the country and coal has to be transported thousands of kilometers to generate electricity there. Generating electricity near coal fields and transmitting electricity would have been much cheaper.

· As India increases the share of renewable energy in its grids, the cost of electricity is likely to go up even further. This is because renewable energy generates electricity sporadically and the demand is round the clock. Grids need to keep excess capacity or store electricity and both of these are costly.

· Agriculture customers and poor domestic customers get free or cheap electricity. The tariff for business customers is kept high to cross subsidize them.

What can the country do to keep the cost of energy low for businesses?

· The simplest answer is to reduce taxes and duties on fossil fuels. It is easier said than done though. This is because governments — at center and state are addicted to the contribution from fossil fuel to balance their budget. I believe however, that the country should make a commitment to providing cheap energy and try to wean itself away from this addiction.

· Electricity distribution companies should clean up their act. This problem is well understood but the solutions are not well implemented. Some of the measures for reforms are

o Reduction of AT&C losses.

o Clear separation between power utility and state.

o Metering consumption of farmers and domestic consumers even if the state decides to provide free electricity.

o Thinking carefully about how they can mitigate the excess costs of renewable energy in the grid. Shifting demand, from evening to the times when renewable generation is maximum, should be strongly encouraged.

Underlying all these measures would be a policy goal to keep energy costs low for businesses. You could point out that a low cost of energy cannot be the only goal for energy policy in India. That is correct. Energy independence is important. So are environmental concerns arising from consumption of fossil fuels. However, as things stand today, we are not meeting any of these goals. We depend mainly on fossil fuel for most of our needs. Most of this fossil fuel is imported. Meanwhile, our businesses pay a high price for energy using up precious money that could have been used for employing people or for expanding the business. A coherent policy that acknowledges these failures would be a small start to setting this situation right.

[1] I have used different sources for data across this post. Also, the data is for different years. This is based on ease availability. A different data source may have significantly different figures and percentages. However, I believe that unless the difference is drastic, the direction of my arguments would not change.

My heartfelt thanks to Neeraj and Manish for helping me understand energy sector better. Thanks also to Rajani for proof reading and catching a million mistakes. Errors mine.

Edit 1 and 2 clarifications made in response to comments received from Deepak. Edit 3 on the basis of comments from Sunay. Thanks to Shankar for clarifying my understanding of indirect taxes on petroleum products and on electricity duty.

Author –

Yogesh Upadhyaya

(Yogesh Upadhyaya is one of the founders of AskHow India. Blogs are personal views.)

You can follow AskHow India (@AskHowIndia) or me (@YogeshUpadh) on twitter or me on LinkedIn or Medium. DM me if you wish me to put you on WhatsApp distribution list.

This is the fifth article in a series on Real Ease of Doing Business (REODB). The first four articles can be found here

1. The local bullying of business .

2. How is China so welcoming of business.