Good Step ! But the fight is by no means over..featured

Imagine you sold your flat in Delhi last month for Rs. 1 Crores. As is the market practice, you took 40 Lakh of this money in cash. Imagine also that in the one month since the sale, you spent only a couple of Lakh from the cash pile. After the government’s declaration yesterday that the current five hundred and thousand rupee notes will no longer be legal tender in India, you are screwed. The next time you sell property, you will not be inclined to take such a large portion of the money in cash. What is more your sorry tale will also persuade your friends and relatives to accept large portions of their property sales in cheque.

Now imagine that your neighbor sold their flat two years ago, again getting Rs. 40 Lakh in cash. However, they immediately spent the cash in their daughter’s wedding and in buying another piece of property. They have probably stepped out right now to give Prasad at the local temple to thank the almighty for their luck! They and their friends would also be cautious about accepting cash next time they sell their property but not as much as you would be.

These two tales illustrate why the move by the government yesterday is good but is not a ‘ramban’ to kill the demon of Black Money.

More formally,

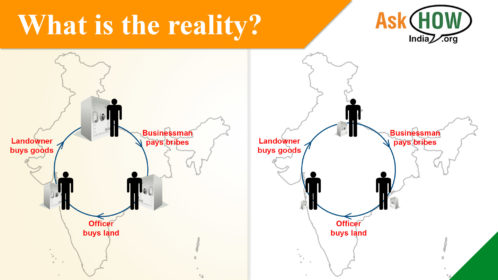

- Some Businesses and professions like doctors take part of their revenues / fees as cash and do not declare it, to avoid paying tax.

- However, the black money thus earned is not entirely ‘stashed away’. The business for example may use it to pay bribes or to make political contributions or might simply give it to another business that is selling its goods in cash. The doctor may buy gold or land or even spend the money. Black Money circulates and only a small portion of this money is kept in cash. We have no way of knowing how much that is.

- The step of stopping use of five hundred and thousand rupee notes makes this stash worthless. This will persuade businesses and professionals to declare more of their income in future. But there are also counter pressures of needing undeclared income to pay bribes, etc. and also to pay lower taxes. A pan masala manufacturer for example, can evade high amount of excise duty today by making cash / undeclared sales.

To summarize this is a good step but will not solve the entire problem. The problem of Black Money is too complex for it to be solved in its entirety by one step alone. And yes, it will be disruptive for our day-to-day lives, but that is a topic for another discussion.

(Yogesh Upadhyaya is a founder of AskHow India. Blogs are personal views)